Trimming debt & budgeting like a baller.

I became debt-free at the end of 2016.

I became debt-free at the end of 2016.

Goal-setting is like a reflex to me, I can't help but do it. For the last few years, I have made it a goal to kick my student loan debt to the curb. I made it a goal but I didn't make it a priority.

The difference between me finally getting rid of my student loan debt and me just talking about it rested in three things: action, sacrifice & focus. I think those are the core components to accomplishing any goal: action, sacrifice & focus.

When I say "student loan debt," I don't mean some small figure. I mean over $60,000 worth of student loans. I knew going into the four years of my higher education that I was taking on this burden. I remember being almost certain that I would never be able to pay it off. I would have regular anxiety about my debt as I watched it accrue with every passing semester.

For nearly five years, I didn't do a thing about my debt. Naturally, it spiraled and became larger as I paid the minimum every month and watched the interest make the number higher than what it was before I began paying it off.

So I made 2016 my year to kill debt. I looked at the $57,000 worth of debt and I decided to face this beast. I was paying about $500 a month and I knew there had to be a smarter way to tackle this debt.

I've wanted to share my tactics for a while but I also want to be open and honest with everyone. I am self-employed and have been for four years. I don't have a fixed salary which comes with its own hurdles but I am able to increase or decrease the money I earn by the number of jobs I take on. I bring this up to say, everyone's road to becoming debt-free will be different. Set a goal that is manageable for you but also stretches you to focus and sacrifice. Achieving goals require discipline. Below are the things I did to discipline myself and erase my debt:

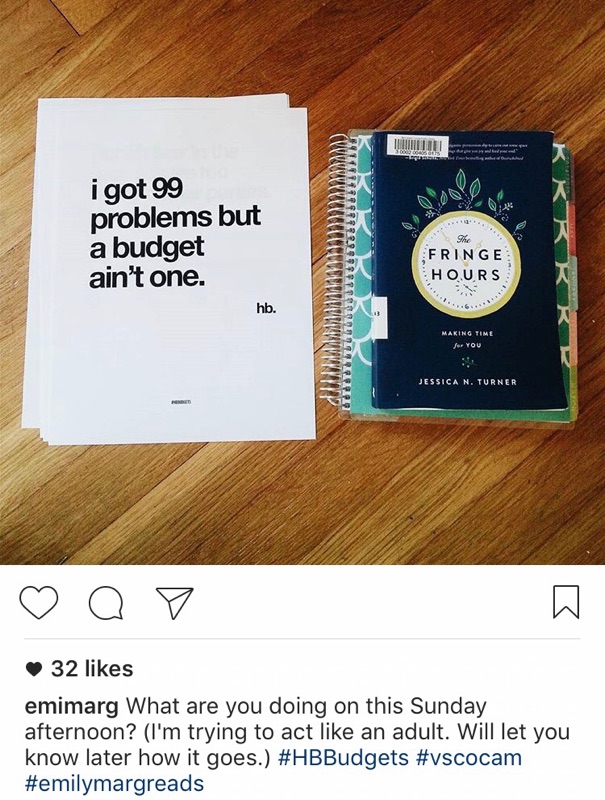

1. Budget, budget, budget

I cannot stress this one enough. I created my own budget sheets last year and I am a really huge fan of them and it's not because I made them. I designed the budget sheets for someone like me who is often scared of numbers and wishes budgeting could be a little more inspirational. I love them only because they're working and I am someone who doesn't use products unless they work. It's been so cool to see people all over the world use these sheets. Someone emailed the other day to tell me she'd been using my budget sheets and, because of them, she erased $7,000 worth of debt.

She said it took her about a year to make it happen (which is freaking awesome) and the biggest things she focused on were: 1) eating out less 2) putting her tithe first 3) taking on extra side-jobs like babysitting.

Using budget sheets has helped me assign my dollars where they ought to go. Plus, I love keeping them in a binder and pushing myself to save better from month to month.

(P.S. there's even a space in the budget sheets for tacos. Because obviously.)

2. Consider a Challenge

At the beginning of 2016, Lane and I took on a Contentment Challenge. For the first three months of the year, he and I didn't buy anything except for necessities, groceries, and the occasional date night. Our minds were sufficiently blown and our bank accounts were thankful.

The coolest thing that happens in a contentment challenge is you figure out where your contentment actually lies. Whether it's cool stuff or the amount of money in your bank account. You figure out what you are dependent upon and what is in the way of reaching a point of contentment. For Lane and I, the common stumbling block where we spent the most money was on food and drinks. We enjoy going out and trying new restaurants. We don't keep ourselves from that experience but the Contentment Challenge helped us to reign in the spending on big dinner tabs and begin enjoying home-cooked meals.

3. Face the Issue

I couldn't begin tackling my debt until I was willing to look my debt in the face. I think we do this a lot with things we are afraid of. We hide them. We shove to the side. My debt was completely normal for a student in 2017 but I made the fear bigger than it needed to be.

The best thing I ever learned to do was look at my debt weekly and remind myself it was there. As I looked at it, I became proactive and started putting money towards chopping down the number. I tackled an $11,000 loan and a $7,000 loan during the Contentment Challenge. I took on extra jobs to whittle down a $5,000 loan. I made myself stare at the debt in order to become less afraid of it.

4. Pay those quarterly taxes

This applies more for the freelance crew out there but I cannot tell you how much of a difference it made for me to pay my quarterly taxes last year. I've dreaded the middle of April for the last four years because I know I will be writing a really large check to the government. However, I paid my quarterly taxes this year and I was free from the anxiety of needing to save unknown pockets of money to not be slammed come tax season. Know what you're working with-- that's why I tell myself now. Pay your quarterly taxes to figure out what is still yours to work with.

WHAT TIPS DO YOU HAVE FOR BUDGETING AND KILLING DEBT? I WOULD LOVE TO CHAT IN THE COMMENTS BELOW!